The ‘Liquidity Trap’ arises from deflation

Figure 1. Monetary base, yields, and GDP (Japan 1994-2015)

This figure shows the relation of yields of JGB, the monetary base and the real GDP on a quarterly basis since 1994. The size of the circle indicates the monetary base.

During the term that the interest rate(yield of 10y JGB) was in a range between 1.0-1.5(10y JGB) or below 0.2(1y JGB), an inflexible rate of interest did not change GDP growth rate. It seemed that GDP growth depended on the financial policy. For example, in 2013, the Government spent 20 trillion Japanese Yen(JPY) for a stimulus economy which shifted right 5 trillion JPY on a quarterly basis in X-axis/GDP. This shows the situation of the deflationary trap that is described in figure 4(IS-LM model) of the following section.

The following section describes whether the monetary easing would affect GDP growth or not.

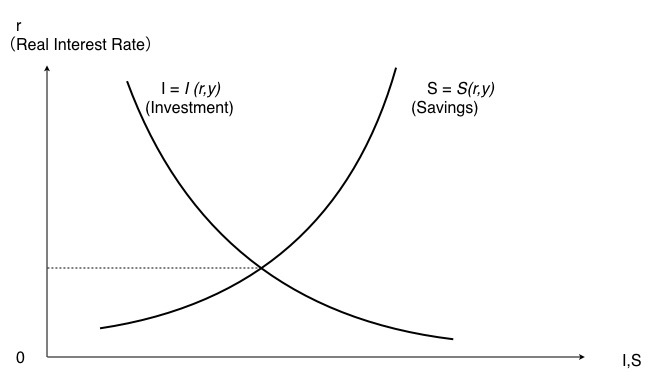

Investment-Savings model

Figure1 shows the relation of both investment and savings to the rate of interest. Investment describes as a function I=I(r) relies on the rate of interest. In other hand, savings describes as a function S=S(y) which relies on a level of yields. The rest of yields(income) Ys except for consumption is savings.

Ys=C+S

The general equilibrium model indicates the equilibrium point of the rate of interest as a point of intersection on figure 2 which corresponds Investment to Savings.

Yd=C+I

Ys will equate to aggregate demand Yd at the equilibrium yield.

Figure 2. Investment-Savings model

Y=C+I and Y=C+S, so it determines the yield and the rate of interest to satisfy with I=S.

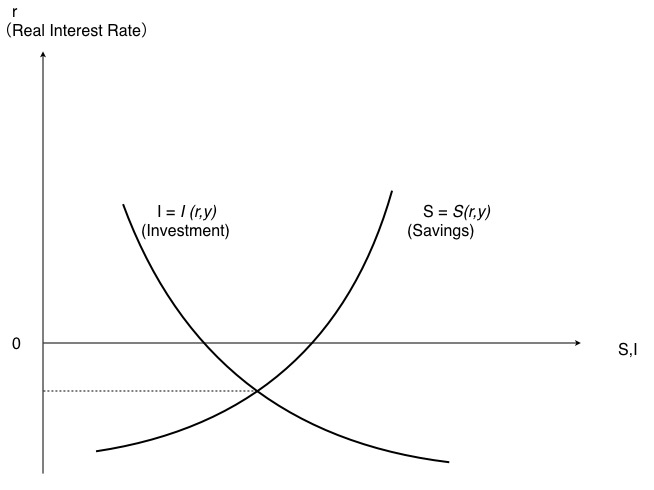

An intersection point of the investment function and the savings function is located in the zone of a negative side on the axis of real interest in figure 3. This indicates equilibrium level of the real interest rate is a negative value. Although the real rate of interest will affect current demand, we can examine the nominal rate of interest in the market. Irving Fisher(1854-1947) provides the relation of the nominal rate of interest and the real rate, described as next equation;1

i = r + π

Fisher equation: nominal rate of interest(i)=real rate of interest(r)+expected rate of inflation(π)

Even if the nominal rate of interest is 0, the expected inflation rate must be a high positive value in order to realize a negative real rate of interest. Figure 3 shows a higher expected inflation rate is required for investment/savings equilibrium.

But we cannot observe the expected rate of inflation. So it is required to grasp a conceptional meaning of this equation.

Figure 3. Investment Savings model

Average rates of inflation are positively correlated with average money growth rates, nominal interest rate and money growth rates should also be correlated. Monnet and Weber examine annual average interest rates and money growth rates over the period 1961 to 1998 for a sample of 31 countries. They find a positive correlation between money growth and long-term interest rates. This evidence is consistent with Fisher equation.

2この

General equilibrium model IS-LM

Hicks(1904-1989) shows modeling the concept of Keynes(1883-1946) economics as IS-LM analysis. Figure 4 describes IS-LM analysis of standard economics. Both goods/services market(IS) and money market(LM) are described as functions of y and r.2

Using equilibrium condition S=I in the goods and services market.

I(r,y)=S(y)

Y=S-1[I(r)]

This shows the equilibrium yield must be a function of the interest rate, and the rate of interest must be also a function of yield. In general

Y=IS(r)

This equation shows a combination of the interest rate and level of yield which realizes the equilibrium of the correspondence savings with investment.

Similarly to this, the money market has a transaction demand for money and an investment demand. Total demand for money described as a function MD=M(y,r) which relies on the rate of interest, must be equal the sum of both demands in the money market. The outline to realize the equilibrium state in the money market is LM-curve shown by the function of demand for money.

Md=L1(y)+L2(r),Ms=L1(y)+L2(r),Ms=Md from the equilibrium condition

Y=L1-1[Ms-L2(r)]

In general, LM-curve is written as the following equation

Y=LM(r)

Figure 4. IS-LM equilibrium model

In a case of monetary easing, it affects money market. LM-curve shifts in the right direction on the yield of the Y axis. In a case of tight money policy, LM-curve shifts in the left direction.3

- Monetary Easing: An increase in the money supply shifts LM-curve to the right side.

- Monetary Tightening: A decrease in the money supply shifts LM-curve to the left side.

It is possible to analyze that LM-curve on figure 4 divides 3 parts, shown as yellow dot line, black line, and red line.

In case that LM-curve intersects IS-curve in the area shown IS’, obviously shifted LM-curve affects the level of the equilibrium rate of interest, then the real rate of interest and yield at the intersection point will change. Monetary easing shifts LM-curve in the right direction, then the real rate of interest will be low and yield level will be high. Against this, tight monetary policy shifts LM-curve in the left direction, the real rate of interest will be high.

When the economy in the USA was under the extreme inflation, FRB succeeded to control inflation by decreasing the money supply. As a result of tightening the money supply, the inflation was calm. Analyzing by use of IS-LM model, LM-curve shifted left as described in figure 4, the real interest rate was up. In this case, business conditions are worse due to becoming lower yield. It can explain naturally to apply the model described as IS’, which an intersection point of IS-curve and LM-curve is in the zone of the positive real interest rate, for the USA economy at that time.

On the other hand, in case that IS-curve intersects a flat line of LM-curve, What would happen when the monetary policy shifts LM-curve?

There is no change both interest rate and yield level. An intersection point of IS-curve and LM-curve does not change the position if LM-curve shifts in either direction. This situation called the ‘liquidity trap’ in Keynes economics which shows the state the monetary policy is not functional. If the economy of some country is such a state, there is no function of the monetary policy.

This state shows LM-curve is flat. In case that IS-curve intersects on the flat line of LM-curve, even if how much large-scale monetary easing will be done, the intersection point on IS-curve is constant in spite of shifting LM-curve in right direction.4

Even if the central bank supplies money for a large-scale monetary easing, both the real rate of interest and the yield do not change.

Financial policies of the government are effective in this economy. This is a concept of the basis of Keynes economics as an effective demand policy. Public investments will shift IS-curve in right direction, the yield(GDP) will increase. The Government borrows money from a private sector issued construction bonds, and creates effective demand by public investment, it affects the positive business environment and increases in GDP. But the debt of the government also increases.[A Fiscal Policy.]

Hicks’s standard IS-LM model, in the case of the liquidity trap that IS-curve intersects in the flat line of LM-curve, while the financial policy is effective, the monetary policy is not functional at all.

If the economy is continuous deflation, such a flat LM-curve happens. After the rise in asset prices by continuous positive feedback, serious debt deflation happens after correcting rise in asset prices. The expected return on investment is very low under the situation, there is no money to invest even though the interest rate is less than enough low. The liquidity-preference holding cash and savings will be dominant ideas. The real rate of interest does not fall down from the positive high value in the result of negative expected rate of inflation because nominal interest rate bounds zero. Figure 4 shows the expected rate of inflation is zero. In the case of the negative rate of inflation, LM-curve becomes flat line at the higher than zero of the real rate of interest.

GDP and tax income have decreased from the peak point in 1997 when VAT raised 5 percent from 3 percent at the same time in Japan.

In 1989 Berlin wall collapsed the end of the cold war of east and west sides. Eastern countries joined market economy, then international trades extended and decreased global production cost. The Japan’s bubble economy collapsed in 1990. Oversupply production facilities and capabilities continue the situation in a short demand. The debt deflation economy with the result of bubble collapse in Japan and globalize economy with the result of the end of the cold war, are proceeding in parallel at the same time. The export leading economy which was depended on foreign demand competed with emerging countries for foreign consumer markets. That competition in the global marketplace would affect the GDP. Lower production cost in emerging countries would affect Japan's deflation economy.

In this way, IS-curve intersects on the flat line of LM-curve that is equilibrium status in Japan. Thus Zero interest rate continued in long term.

If the levels of GDP of Japan’s economy and the interest rate are stable equilibrium state shown in figure 4 that IS-curve intersects on the flat line of LM-curve, monetary policy is not functional at all. The quantitative easing of the BOJ called QQE, try an increase in the money supply. IS-LM model shown in figure 4 corresponds to current Japan’s economy, a large-scale monetary easing is no effect for the both yield(GDP) and rate of interest. This is a result in a case that Hicks’s standard IS-LM model apply for. Although the model is an approximation of real world, it describes current economic status. There is no difference for real world economy.

The monetary easing does not effect for GDP positive growth and not getting rid of deflation under this economic situation.

Rising stock prices and its income effect reflects changes in FX(foreign exchange) rate that export industries relied on. There is no correlation of the change in FX rate and an increase in the money supply by monetary easing.

The rate of interest is related to FX rate. There is a model that assumes FX rate shift in direction of correcting the difference in the rate of interest between domestic and a foreign country, then it shows the relation of current account balance and FX rate. There is a case that an increase in the money supply affects the rate of interest indirectly. But an increase in the money supply does not affect the rate of interest on the flat LM-curve shown in figure 4 at all.

2The equilibrium for goods and services market Y=IS, the equilibrium for money market Y=LM

where y=S-1[I] is the inverse function of I=S(y)3A monetary tightening and a monetary easing for money supply.

4The correlation between inflation and the growth rate of the money supply is almost 0. (despite Weber's examination.[Fisher equation])

The Quantity theory of money and expected rate of inflation

A basis of the opinion of economists who proceed the quantitative easing policy is Fisher equation that is the relation of the real rate of interest and expected rate of inflation described in above section. They insist an increase in the money supply purchasing bonds leads to an increase expected rate of inflation, then the real rate of interest will be low. They will try to effect higher expected rate of inflation in order to realize the negative real rate of interest that is the equilibrium of investment and savings shown in figure 3.

- An increase in the money supply → raise the expected rate of inflation

But the expected rate of inflation isn't an observation numerical value. An increase in the money supply may effect the expected rate of inflation, only if both economic indicators have a relation of linear dependence 5. It is a P/M=L(r) or the quantitative theory of money which is shown as the following equation;

MV=yP

M:Money V:Velocity P:Prices y:YieldsThese equations show the relation of money supply and prices.

In case that the viewpoint is the relation of the prices and money supply, the sum of money affects the prices. M/P=L(r). This shows only transaction demand for money, and it does not consider the price difference in domestic/foreign countries. They focus the model on the assumption that an increase in the money supply will affect prices of goods.

Against monetarist insistence of the dependency of money supply and prices of goods, post-Keynesian insists prices of goods are under the markup pricing. The price level of goods is determined previous cost and markup function. Producers will add markup as a profit to past prices of goods and labor cost. The level of prices of goods is determined as the sum of markup and total cost which contained labor cost of a production system and other principle costs in addition to profit margin.

Improvement of productivity by innovation and lower price of import Middle goods affected by FX rate make prices of goods fall down. A move the new production base to a foreign country to improve price competitiveness is also fall in prices. Proceeding globalization and improving productivity by innovation make prices of goods fall.

Deflation, flat line of LM-curve shown in figure 4, is happened by the result of the mutual effect of industrial structure in Japan and proceeding globalization.

Prices of goods fall down, if a company selects a strategy to have an advantage improving price competitiveness of their products. This is a natural result for markup pricing model.

There is no relation an increase/decrease in the domestic money supply to a difference of domestic/foreign production cost which contains labor cost and prices of goods. This relies on emerging countries economic growth. The situation continues as far as emerging countries develop the economy. A move production base from domestic to foreign country relies on the foreign exchange rate. Japan’s deflation is stable situation results in mutual effects of globalization and Japan's export-oriented industries. It is difficult to get rid of deflation economy as far as the industrial structure is stable.6

Monetary easing by the central bank is no effect on the interest rate and prices of goods, if the yield and the real interest rate(r) are equilibrium state in the zone on flat line of LM-curve on IS-LM model shown in figure 4 (in other words, if Japan’s economy falls into the state of the liquidity trap).

In the case of the special situation, liquidity trap, a general equilibrium model of macroeconomics shows as a natural condition that monetary policy does not effect at all.

Then the rate of interest falls down the level no less than it. If the investment does not increase so that the expected return on investment is low even as the interest rate is such low levels, the economy continues the state that investment is lower than savings. This means oversupply and insufficient aggregate demand. So prices of goods fall down, and a rise in the real rate of interest leads to a decrease in investment. Savings is surplus to investment, the aggregate supply is surplus to insufficient aggregate demand, this is the state of deflation. The expected return of investment is extremely low, it cannot get rid of the status of that investment does not respond to the interest rate changes.

The FX rate was overshoot after the Lehman shock in 2008. And the yen appreciation was also overshot for the purpose of swindling money out of the MOF special account of foreign exchange from 2010 to 2012. The Nikkei Stock Average was in a range of 8000 ~ 9000 JPY in those years. The economy in the ‘liquidity trap’ could not leap from the zone of inflexible interest rate for investment.

The rise in stock price of Nikkei Average since 2013 is the result of correcting FX rate. Monetary easing did not affect it. Regarding the rise in stock price as a result of monetary easing is a recognition error based on selective bias7. If Japan’s economy is in the state of the ‘liquidity trap’, monetary easing policy by an increase in the money supply does not affect both the interest rate and yield, which does not improve the status of oversupply/weak-demand.

The rise in stock price caused of improving the expected return on investment correcting FX rate. This is obviously the correlation of the changes of two indices, Nikkei stock average and USD/JPY FX rate.(Figure 5)

Figure 5. Changes of USD/JPY FX rate and Nikkei stock average.

The recognition that monetary easing caused of the rise in stock price is a schema of the cause-effect relation. The problem recognition based on selective bias continues failed decision making.

Such a schema sometimes leads you to severe error to make a bad situation worse. For example, the currency intervention for the purpose of restraining yen appreciation does not change in FX rate but gives a large amount of money to the fraud group by using the intervention opportunity for the arbitrage transaction.8

CONT.

On the assumption that increase in the money supply raises the expected rate of inflation, the central bank continued to buy bonds to increase the money supply.

5Modeling the term of prosperity/depression as a distribution function

The essay shows an example of consumer society that does not meet the quantity theory of money. It is not obvious that dependency of an expected rate of inflation and an increase/decrease in the money supply, also whether the central bank purchasing Treasury bonds effects inflation rate or not.

6Imagine extending the concept of the ‘innovator’s dilemma’ to country level on the condition that has own industrial structure, production system, and society. Whether the revenue structure and the trade surplus of the balance of payment on the industrial structure will continue or not. Japan faces in the aging society soon.

Clayton M.Christensen describes ‘When new technologies cause great firms to fail’.

7Selective bias

It tends to create the cause-effect relation selecting information for their favorite. They squeeze the fact into the preferred cause-effect template. In spite of setting the target value of money supply to double quantity in the past, the CPI does not rise against expectation in this term.