Predictions of FX rate

Price changes in financial market

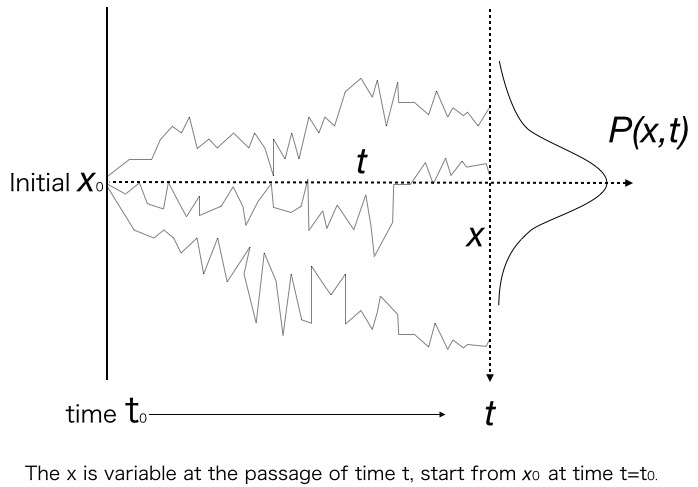

Please see the sample path of the Winner process described as Fokker-Planck equation, Langevin equation

Figure1. Sample paths of the Winner process

The changes of FX rate after the passage of time t determined prediction range as diffusion of the distribution function on the assumption that the changes of FX rate relies on the stochastic process described as the Winner process.

The following figure shows the prediction range and sample paths that rely on the Winner process.

x0------------------->

t=0t

The figure describes color which becomes to thin for the edge of the distribution. The Color density defines as stochastic density. This density of the color spreads through a sample path. It predicts the value of x at the passage of time t by stochastic distribution P(x,t) and initial value x0 at t=0. A part the stochastic distribution cut off several percent of both edges of the distribution is the expectation range.

This is a prediction at the passage of time t on the assumption that the price changes of the FX rate relies on historical volatility. Off course, even if the range cut off the both edge of the distribution, the price changes happen more than expected range. An occurrence probability is not zero.

Once it happens, shift initial value x0, stochastic distribution of the prediction after the new time t also shifts to event X’0 side which has already happened.

In case that the FX(foreign exchange) rate or a component of the portfolio in the financial market are similar to a component of the portfolio held by market participants, the market behavior changes extreme in one direction when specific event happens. This estimates increase down side risk when the specific event happens.It supposes easy that the risk relies on the component of the portfolio held market participants,not on the historical volatility.

The market approximation and expectation which rely on the stochastic model on the basis of volatility can not describe a potential risk in such a market. The measurement value used of VaR cannot grasp the size of risk of the market which is composed of the similar portfolio of market participant in specific situation.

The fluctuation range of x can predict by the stochastic distribution P(x,t) that relies on the historical volatility. But the accuracy of approximation of the change distribution in the market is low after the initial value x0 extreme change,in the market that market participants hold similar portfolio component, even though use of the GARCH model.

The central bank or the government intervenes into FX market directly, come under the examples. The supply-demand in the market or a portfolio component of market participants tend to make an unbalanced gap. Buying the foreign currency increase foreign currency reserve to control the changes in constant range. The government foreign currency reserved has increased that may happen potential down side risk in the future. The risk is not appeared in historical volatility at all. The risk exists in the country that as a production base and continue economic development and produce goods.

The precision of approximation of a real event is determined which a stochastic model is applied for.

On the other hand. What is the basis of the prediction range by the expert FX strategist ?

The prediction of FX rate or stock indices introduces stochastic models, then the volatility in financial market provides the tool which shows the numerical value for the probability. It provides the method for the numerical value as a standard decision method. It is based on the approximation of real world price changes.

The prediction of FX strategist focus on the government economic indices, focus on the corporate investment activities at another time. A term is unclear in comparison with the expectation of tools. The prediction range of the rate is not cut off the both edge of the stochastic distribution. A basis of production range is ambiguous. The premise condition of the model is also unclear.

Although the prediction does not assure the result, A non-professional and an expert correspond to the prediction range. Does non-professional has a competence of viewpoint to the market who corresponds the prediction to expert prediction range ?

It cannot say that the both expert and non-professional grasp the market in complete. The probability when they mentioned X percent of probability is called ‘Subjective Probability’ in the area of the behavioral finance. There is no premise conditions or restriction conditions that is the study theme about phycology and decision making. The numerical value itself has no mathematical strictness.

Such a prediction that there is no premise condition spreads in real society.

The VaR or volatility in financial market show the premise condition to provide the value and a stochastic model. The condition is an assumption that price change relies on the normal distribution or historical volatility.

As shown the pageModel and statistical model, in case modeling real world events, the choice of a model to approximate determines the accuracy and the basis of the prediction.